Structured Investnet

Performance track record database built exclusively for the discovery and comparison of

Defined Outcome SMA Strategies.

Access industry-first Defined Outcome Investment Universes.

Why is Structured Investnet so unique?

Structured Investnet is the only purpose-built solution to track, compare, and analyze defined outcome strategies offered as a separately managed account (SMA).

Defined Outcome SMA Strategy Database

View and compare SMA offerings from leading providers.

Defined Outcome Investment Universes

First ever classification system for Structured Note SMA strategies enables true peer group comparison.

Track record analytics and reporting

Build client-friendly PDF reports that display individual strategy performance vs. universe.

TransparEncy starts here

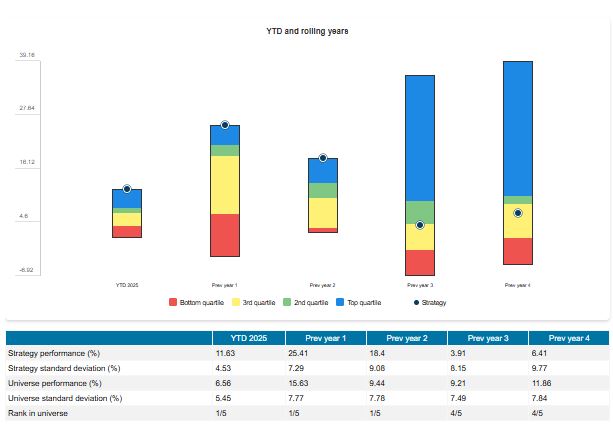

Annualized Performance vs. Universe

Compare the selected strategy performance vs. the Universe for Year to Date (YTD), and annualized periods up to four years. Includes performance, standard deviation and rank.

Quarterly Performance vs. Universe

Compare the selected strategy performance vs. the Universe for trailing quarterly periods up to two years. Includes performance and rank.

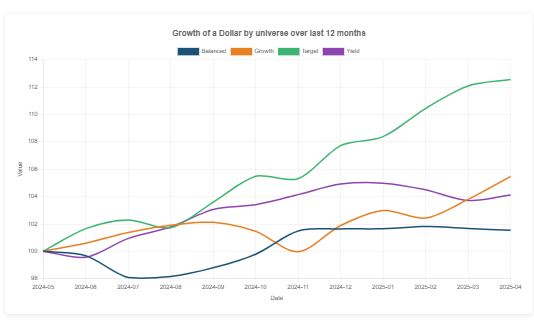

Universe Growth of a Dollar Comparison

For the selected Defined Outcome Investment Universe, visualize the growth of a dollar performance chart for all strategies in the Universe.

peer group comparison

Defined Outcome Investment Universes

Providing new standards for a growing market, our unique investment universes allow for true side-by-side comparison

Yield

The Yield and High Yield Universes consist of SMA strategies that primarily utilize income-generating structured notes, including those with callable, fixed-coupon, or auto-call features. These strategies are typically designed to deliver regular cash flows with high to moderate yield and may be linked to individual stocks, broad indices, or baskets.

Learn more about Yield

Growth

The Growth Universe includes SMAs that focus on structured notes with uncapped or high-capped upside participation, designed to maximize returns in bullish or trending markets. Annualized caps, when present, tend to be well above traditional growth benchmarks, enabling potential for strong equity-like returns.

Learn more about Growth

Target

Strategies in this Universe hold structured notes with performance caps that align with a return objective. The annualized cap functions as a “target return,” often with conditional or buffered downside protection. These strategies are for investors looking to lock in a specific return profile over a defined timeframe, often with favorable tax treatment.

Learn more about Target

Blended

The Blended Universe captures SMA strategies that combine elements of Yield, Growth, and Target Return profiles. For example, a strategy may allocate across income-producing notes and also capped-growth notes to deliver a balanced risk/return outcome.

Learn more about Blended

20

Managers

Top tier asset managers with significant assets under management and multi-year track records.

32

Strategies

A wide selection of Defined Outcome investment strategies include Yield, Growth, Target and Blended.

4

Universes

Compare strategies against other similar offerings with the industry’s first Defined Outcome Investment Universes.

why defined outcome investing?

Achieve Your Client’s Goals

Reducing uncertainty in the outcomes of investment returns will improve your ability to achieve you client’s investment goals

RIAs & Financial Advisors

If you are looking for more stable and well defined investment outcomes in a Separate Managed Account (SMA), access Structured Investnet today and find the right solution for your client.

Asset Managers

If you are an asset manager that offers a Structured Note SMA and would like to have your track record included in our universes, contact us today so we can review your strategy and add you to the database.

Institutional Consultants

If you are an Institutional Fund Consultant and are interested in a more in-depth analytical view of the performance universes for your institutional clients, contact us today so we can provide a demonstration.